Pradhan Mantri MUDRA Yojana (PMMY)

GENESIS AND ROLE OF MUDRA

What is MUDRA

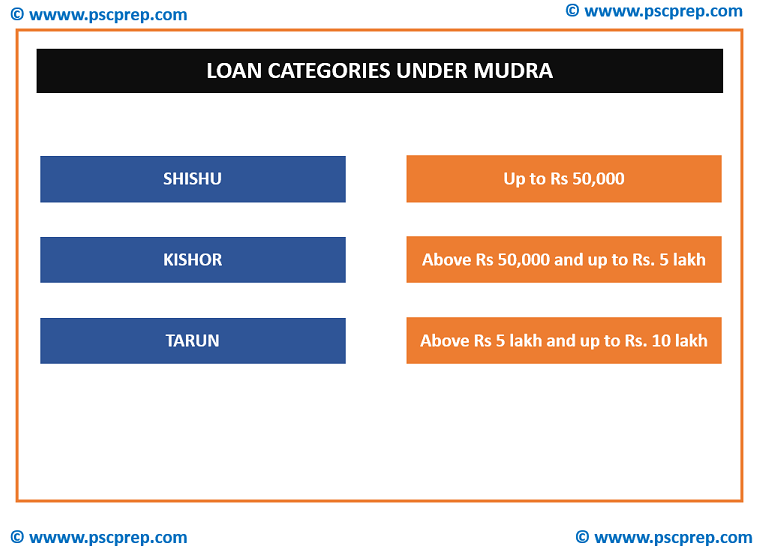

Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Hon’ble Prime Minister on April 8, 2015 for providing loans upto 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs. The borrower can approach any of the lending institutions mentioned above or can apply online through this portal. Under the aegis of PMMY, MUDRA has created three products namely ‘Shishu’, ‘Kishore’ and ‘Tarun’ to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth.

- Shishu: covering loans up to Rs 50,000

- Kishor: covering loans above Rs 50,000 and up to Rs. 5 lakh

- Tarun: covering loans above Rs 5 lakh and up to Rs. 10 lakh

The Genesis of MUDRA

The Union Budget presented by the Hon’ble Finance Minister Shri Arun Jaitley, for FY 2015-16, announced the formation of MUDRA Bank. Accordingly MUDRA was registered as a Company in March 2015 under the Companies Act 2013 and as a Non Banking Finance Institution with the RBI on 07 April 2015. MUDRA was launched by the Honourable Prime Minister Shri Narendra Modi on 08 April 2015 at a function held at Vigyan Bhawan, New Delhi. (MUDRA) Bank was set through a statutory enactment. This Bank would be responsible for regulating and refinancing all Micro-finance Institutions (MFI) which are in the business of lending to micro/small business entities engaged in manufacturing, trading and services activities. The Bank would partner with state level/regional level co-ordinators to provide finance to Last Mile Financer of small/micro business enterprises.

The Need of MUDRA- Micro Enterprises

Micro enterprises constitute a major economic segment in our country and provides large employment after agriculture. This segment include micro units engaged in manufacturing, processing, trading and services sector. It provides employment to nearly 10 crore people. Many of these units are proprietary/ single ownership or Own Account enterprises and many a time referred as Non Corporate Small Business sector.

The Need of MUDRA-The Non-Corporate Small Business Sector

Non-Corporate Small Business Sector (NCSBS) is the economic foundation of India. It is perhaps one of the largest disaggregated business ecosystems in the world sustaining around 50 crore lives.

The sector comprises of myriad of small manufacturing units, shopkeepers, fruits / vegetable vendors, truck & taxi operators, food-service units, repair shops, machine operators, small industries, artisans, food processors, street vendors and many others.

Formal or institutional architecture has not been able to reach out to them to meet the financial requirements of this sector. They are largely self financed or rely on personal networks or moneylenders. Addressing this need will give a big boost to the economy otherwise this segment would remain unfunded and a portion of the productive labour force would remain unemployed.

Small business is big business. According to NSSO Survey (2013), there are 5.77 crore small business units, mostly individual proprietorship. Most of these ‘own account enterprises’ (OAE) are owned by people belonging to Scheduled Caste, Scheduled Tribe or Other Backward Classes. They get very little credit, and that too mostly from non formal lenders, or friends and relatives. Providing access to institutional finance to such micro/small business units would turn them into strong instruments of GDP growth and also employment. Mainstreaming these enterprises will not only help in improving the quality of life of these entrepreneurs but will also contribute substantially to job creation in the economy thereby achieving higher GDP growth.

The Need of MUDRA – The Micro Constraints

The major constraints faced by the myriad of the micro enterprises along the length and breadth of the country include :

- Access to Finance

- Infrastructure Gaps

- Lack of growth orientation

- Skill Development Gaps

- Policy Advocacy Needs

- Lack of Market Development / Market Making

- Knowledge Gaps

- Information Asymmetry

- Entry Level Technologies

The biggest bottleneck to the growth of entrepreneurship in the NCSBS is lack of financial support to this sector. The support from the Banks to this sector is meagre, with less than 15% of bank credit going to Micro, Small and Medium Enterprises (MSMEs).

A vast part of the non-corporate sector operates as unregistered enterprises. They do not maintain proper Books of Accounts and are not formally covered under taxation areas. Therefore, the banks find it difficult to lend to them. Majority of this sector does not access outside sources of finance.

Structure of MUDRA

In the above backdrop the Micro Units Development & Refinance Agency Ltd (MUDRA) was set up by the Government of India (GoI). MUDRA has been initially formed as a wholly owned subsidiary of Small Industries Development bank of India (SIDBI) with 100% capital being contributed by it. Presently, the authorized capital of MUDRA is 1000 crores and paid up capital is 750 crore, fully subscribed by SIDBI. More capital is expected to enhance the functioning of MUDRA.

This Agency would be responsible for developing and refinancing all Micro-enterprises sector by supporting the finance Institutions which are in the business of lending to micro / small business entities engaged in manufacturing, trading and service activities. MUDRA would partner with Banks, MFIs and other lending institutions at state level / regional level to provide micro finance support to the micro enterprise sector in the country

Roles and Responsibilities of MUDRA

MUDRA has been formed with primary objective of developing the micro enterprise sector in the country. Subsequently GOI has also decided that MUDRA will provide refinance support, monitor the PMMY data by managing the web portal, facilitate offering guarantees for loans granted under PMMY and take up other activities assigned to it from time to time. Accordingly MUDRA has been carrying out these functions over the last one year.

The MUDRA Bank would primarily be responsible for –

1) Laying down policy guidelines for micro/small enterprise financing business

2) Registration of MFI entities

3) Regulation of MFI entities

4) Accreditation /rating of MFI entities

5) Laying down responsible financing practices to ward off indebtedness and ensure proper client protection principles and methods of recovery

6) Development of standardised set of covenants governing last mile lending to micro/small enterprises

7) Promoting right technology solutions for the last mile

8) Formulating and running a Credit Guarantee scheme for providing guarantees to the loans which are being extended to micro enterprises

9) Creating a good architecture of Last Mile Credit Delivery to micro businesses under the scheme of Pradhan Mantri Mudra Yojana

Role of MUDRA in microfinance

Micro Finance is an economic development tool whose objective is to provide income generating opportunities to the people at the bottom of the pyramid. It covers a range of services which include, in addition to the provision of credit, many other credit plus services , financial literacy and other social support services. The players in the Micro Finance sector can be qualified as falling into 3 main groups:- the SHG-Bank linkage model started by NABARD, the Non Banking Finance companies and the others including Trusts, Societies etc.

Monitoring of MUDRA

MUDRA was given the responsibility of monitoring the programme by collecting the information on regular basis. Accordingly, MUDRA has put in place a monitoring portal which captures the data on lending under PMMY, in a granular fashion.

MUDRA as a refinancing institution

“MUDRA is a refinancing Institution. MUDRA do not lend directly to the micro entrepreneurs / individuals. Mudra loans under Pradhan Mantri Mudra Yojana (PMMY) can be availed of from nearby branch office of a bank, NBFC, MFIs etc. Borrowers can also now file online application for MUDRA loans on Mudramitra portal (www.mudramitra.in). There are no agents or middleman engaged by MUDRA for availing of Mudra Loans. The borrowers are advised to keep away from persons posing as Agents of MUDRA .”

Allocation under MUDRA

A sum of Rs 20,000 crores would be allocated to the MUDRA Bank from the money available from shortfalls of Priority Sector Lending for creating a Refinance Fund to provide refinance to the Last Mile Financers. Another Rs 3,000 crore would be provided to the MUDRA Bank from the budget to create a Credit Guarantee corpus for guaranteeing loans being provided to the micro enterprises.

The above measures would not only help in increasing access of finance to the unbanked but also bring down the cost of finance from the last Mile Financers to the micro/small enterprises, most of which are in the informal sector.

| State/UT-wise details of number of loans and amount sanctioned under Pradhan Mantri Mudra Yojana [Amount Rs. in Crore] | |||||||

| Sr No | State Name | FY 2015-16 | FY 2016-17 | FY 2017-18 (as on 23/02/2018) | |||

| No Of A/Cs | Sanction Amt | No Of A/Cs | Sanction Amt | No Of A/Cs | Sanction Amt | ||

| 1 | Andaman and Nicobar Islands | 24719 | 218.36 | 3353 | 80.15 | 3337 | 77.64 |

| 2 | Andhra Pradesh | 795688 | 6104.14 | 587569 | 6078.01 | 620637 | 7289.53 |

| 3 | Arunachal Pradesh | 4625 | 74.38 | 6109 | 81.46 | 8717 | 80.25 |

| 4 | Assam | 427272 | 1817.62 | 1255754 | 4908.3 | 1387444 | 4773.88 |

| 5 | Bihar | 2451439 | 7553.83 | 3756716 | 12190.6 | 3580230 | 12162.01 |

| 6 | Chandigarh | 22605 | 212.42 | 19039 | 229.01 | 13047 | 263.47 |

| 7 | Chhattisgarh | 639711 | 2265.5 | 884941 | 3334.27 | 704451 | 3161.89 |

| 8 | Dadra and Nagar Haveli | 1236 | 21.72 | 2587 | 23.49 | 2859 | 26.73 |

| 9 | Daman and Diu | 1109 | 12.43 | 774 | 12.61 | 868 | 16.42 |

| 10 | Delhi | 394388 | 2947.68 | 224975 | 3762.95 | 185697 | 3310.61 |

| 11 | Goa | 45471 | 399.33 | 31289 | 390.2 | 32934 | 393.11 |

| 12 | Gujarat | 1086407 | 6034.73 | 1103453 | 7781.94 | 1049616 | 7644.07 |

| 13 | Haryana | 745535 | 3259.27 | 716622 | 3843.53 | 600272 | 4069.71 |

| 14 | Himachal Pradesh | 85564 | 998.78 | 82851 | 1281.72 | 71569 | 1448.53 |

| 15 | Jammu and Kashmir | 57974 | 1185.13 | 89712 | 1845.37 | 85774 | 2112.25 |

| 16 | Jharkhand | 872868 | 2944.33 | 1023593 | 4004.13 | 969210 | 3995.27 |

| 17 | Karnataka | 4459609 | 16861.35 | 3933578 | 18002.55 | 3555452 | 16331.52 |

| 18 | Kerala | 830411 | 4857.68 | 982260 | 6288.62 | 1243824 | 6970.47 |

| 19 | Lakshadweep | 740 | 6.58 | 473 | 5.64 | 1052 | 14.04 |

| 20 | Madhya Pradesh | 2511191 | 8096.74 | 2683052 | 10506.45 | 2274797 | 10772.59 |

| 21 | Maharashtra | 3535065 | 13806.48 | 3344154 | 17286.66 | 2779841 | 15917.17 |

| 22 | Manipur | 24021 | 131.42 | 21865 | 156.05 | 23029 | 150.72 |

| 23 | Meghalaya | 19151 | 166.48 | 23915 | 189.97 | 21258 | 150.69 |

| 24 | Mizoram | 7772 | 86.5 | 6973 | 101.2 | 10462 | 124.94 |

| 25 | Nagaland | 5134 | 85.89 | 11051 | 114.06 | 12132 | 113.49 |

| 26 | Odisha | 2343261 | 5694.86 | 2606769 | 7891.34 | 3020902 | 9326.37 |

| 27 | Pondicherry | 82866 | 337.84 | 130360 | 490.62 | 114033 | 684.82 |

| 28 | Punjab | 653973 | 3572.42 | 705569 | 4640.84 | 645833 | 4954.27 |

| 29 | Rajasthan | 1159819 | 5484.95 | 1204837 | 9024.71 | 1241217 | 9263.92 |

| 30 | Sikkim | 6889 | 59.53 | 19865 | 99.88 | 19765 | 83.03 |

| 31 | Tamil Nadu | 4781567 | 15846.14 | 5309857 | 18052.68 | 4183919 | 17394.3 |

| 32 | Telangana | 400761 | 3834.55 | 482694 | 3878.38 | 282985 | 3349.71 |

| 33 | Tripura | 68146 | 372.06 | 253807 | 999.42 | 296742 | 1118.54 |

| 34 | Uttar Pradesh | 3345382 | 12275.88 | 3337547 | 15282.61 | 3430417 | 16239.09 |

| 35 | Uttarakhand | 360007 | 1788.39 | 286579 | 1974.12 | 208379 | 1970.88 |

| 36 | West Bengal | 2628548 | 8033.88 | 4566505 | 15695.01 | 4221283 | 16145.2 |

| Total | 34880924 | 137449.27 | 39701047 | 180528.5 | 36903984 | 181901.12 | |

| Source: As per data reported by Member Lending Institutions on MUDRA Portal | |||||||